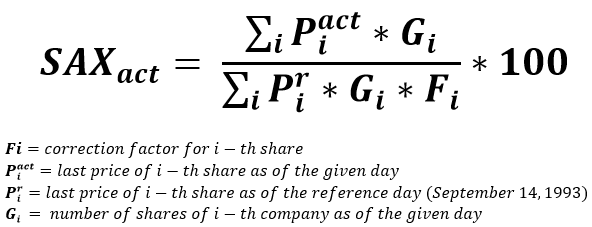

The Slovak share index (SAX) is the official share index of the BSSE. The SAX is a capital-weighted index that compares the market capitalization of a selected set of shares with the market capitalization of the same set of shares as of a given reference day. The SAX index reflects an overall change of assets connected with an investment in shares that are included in the index. This means that, besides fluctuations of prices, the index also includes dividend payments and revenues connected with changes of share capital amount (that is, the difference between current market price and the issue price of new shares).

The initial value of the SAX index – 100 points – refers to September 14, 1993. The index reflects development only on the BSSE, and until June 30, 2001 it was based on average prices stated in the price lists. Effective as from July 1, 2001 the official daily index value is calculated on the base of last prices of shares.

The SAX index formula is flexible and allows for participation of various companies in the index, as well as changes in the number of companies, proportional to changes in their tradeability, or in the case of a new company entering the capital market. In the case of a change in the index’s structure, the correction factors are set in such a way that the index with the new structure continuously follows the development of the index with the previous structure.

Only companies listed on the regulated market can be included into the SAX Index base and weight of each company in the SAX Index base must not exceed a maximum 20%. A regular revision of the base is carried out twice a year. An updated base comes into effect always on the first stock exchange day of the months of February and August of the current year.

Notice:

Bratislava Stock Exchange (“BSSE”) is not an authorised or registered administrator of the SAX index according to Article 34 of the Regulation (EU) 2016/1011 of the European Parliament and of the Council of 8 June 2016 on indices used as benchmarks in financial instruments and financial contracts or to measure the performance of investment funds, and amending Directives 2008/48/EC and 2014/17/EU and Regulation (EU) No 596/2014 (the “Regulation”).

The European Securities and Markets Authority (“ESMA”) establishes and maintains a public register that contains, inter alia, information on the identities of the administrators authorised or registered according to Article 34 of the Regulation and the competent authorities responsible for the supervision thereof. Further information can be found at: https://www.esma.europa.eu/databases-library/registers-and-data.

According to the Regulation, financial institutions that use indices as underlying assets for financial instruments, financial contracts or to measure the performance of investment funds shall not add a reference to a benchmark of an administrator not found in the aforementioned register of ESMA.